Georgia Is a world Leader in FinTech

Due to the presence of an unprecedented number of financial technology industry leaders in Georgia is one of the world's leaders. When you stop for a moment and think about how interconnected the world is, it can boggle your mind. While language, culture, history and many other factors still separate people, the tightly interwoven economies of nearly every nation on earth has created an unprecedented atmosphere of mutual cooperation and international interest. A huge part of that international economic reality is the use of technology to facilitate financial transactions and investments in near-real time, no matter where on the globe the money originates or ends up. To illustrate, consider one powerful case study that could only be observed in the hyper-connected 21st century: the rise of financial technology (FinTech) in the State of Georgia.

Due to the presence of an unprecedented number of financial technology industry leaders in Georgia is one of the world's leaders. When you stop for a moment and think about how interconnected the world is, it can boggle your mind. While language, culture, history and many other factors still separate people, the tightly interwoven economies of nearly every nation on earth has created an unprecedented atmosphere of mutual cooperation and international interest. A huge part of that international economic reality is the use of technology to facilitate financial transactions and investments in near-real time, no matter where on the globe the money originates or ends up. To illustrate, consider one powerful case study that could only be observed in the hyper-connected 21st century: the rise of financial technology (FinTech) in the State of Georgia.

Transactions on a Global Scale Pass Through Georgia

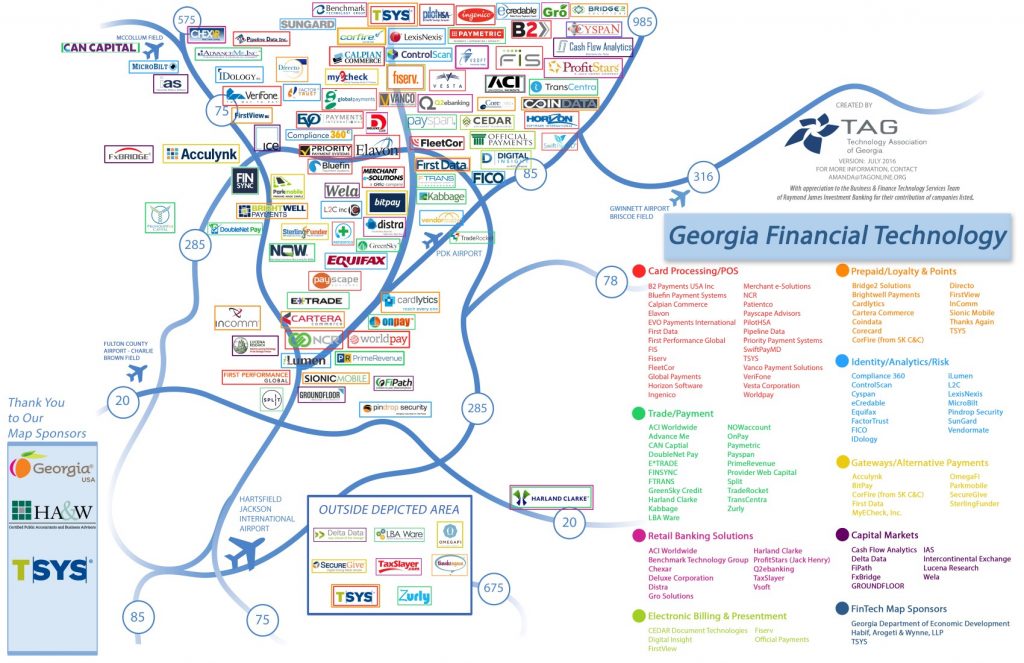

"New York and London may be global financial services leaders, but Atlanta is the unsung — so far — leader in financial technology," writes Tom Groenfeldt for Forbes magazine, noting that, 70 percent of all global financial transactions pass through companies headquartered in Metro Atlanta. Groenfeldt adds that Atlanta promoters have dubbed the city Transaction Alley due to the presence of payment processing leaders like First Data, WorldPay, Global Payments and TSYS. Other international FinTech leaders like FIS and Fiserv, while not headquartered in Georgia, maintain large operations there due to easy access to a skilled and experienced workforce, and consistently favorable infrastructure. These optimal conditions benefit established international FinTech leaders as well as disruptive new startups looking to innovate and grow. For example, the huge Atlanta-based credit reporting corporation Equifax recently developed a new data analytics environment that uses big data to deliver actionable insights that used to take weeks to obtain in mere minutes. Other smaller startups disrupting FinTech from their Georgia bases include: Groundfloor (crowdfunding real estate and investing), Kabbage (small business finance), Prime Revenue (financial supply chain optimization), and BitPay (Bitcoin payment processing). Consider:

- The top 50 Georgia-based FinTech companies generate annual revenue of more than $72 billion.

- 6 of the 10 largest U.S. payment processing firms are headquartered in the state.

- More than 30,000 professionals in Georgia (and over 130,000 globally) are employed by Georgia-based FinTech firms.

- These companies process over 118 billion transactions (over $2 trillion) per year supporting nearly 4 million merchants.

Why Georgia FinTech Companies?

"Smart regulation and civic partnership between industry and government has benefited the business environment in Georgia," concluded Professor Sadheer Chava of Georgia Tech, "and can be a bigger catalyst going forward." Additionally, the broader benefits of living and working in Georgia continue to attract top talent from across the country and the world. The low cost of living, the largest, most traveled airport in the world (Hartsfield-Jackson International which puts 80 percent of the U.S. population within two hours of Atlanta), old-fashioned Southern hospitality, and an excellent quality of life are among the benefits allowing the more than 100 Georgia-based FinTech firms to build thriving workforces that can continue fueling growth. The growth of the FinTech industry is supported by the Georgia Center of Innovation for Information Technology, which approaches creating beneficial connections for FinTech firms from the state perspective. The organization works with an extensive and tech-heavy university system, government agencies, and other businesses within the state to help companies find the resources necessary to grow and remain competitive. "The Center of Innovation serves as a connection to anything a company needs to grow and thrive, and it works to make the necessary connections so that a company can find success. Georgia is unique in that regard; and there are not too many other states doing this," said Whitley. Due in no small part to these organized efforts, the FinTech industry continues to grow and thrive in Georgia.